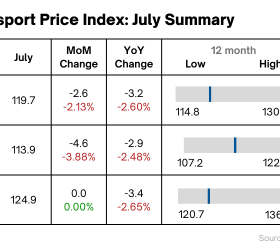

New data from the TEG Road Transport Price Index reveals that road transport prices in the UK fell 2.13% during July, with haulage prices dropping just under 4%.

However, prices have been relatively stable so far this year, marching slowly upwards since February. The combined haulage and courier index had risen by less than 8 points up to July. And the courier price-per-mile has remained almost unchanged since April 2023 – a continuing trend with no change from June 2023 to July 2023.

But now, with the HGV levy back and ULEZ in force later in August, operators will face higher costs and may have to raise their prices.

At the same time, with the Tories winning the Uxbridge and South Ruislip byelection on an anti-ULEZ ticket, the government has started rethinking its green vehicles policy and has turned back to fossil fuels. This may mean electric vehicle investment suddenly becomes less necessary – as will road transport price hikes.

ULEZ frustrations – and knock-on effects

The High Court’s decision to rubber-stamp the ULEZ expansion was met with dismay in some quarters.

Most diesel vans registered before September 2015 will have to pay the charge, as well as most petrol vans produced before January 2006. Transport for London estimates that more than 200,000 drivers of non-compliant vehicles will be affected. Greater London and the surrounding counties are home to a collective 33% of the UK’s vans.

Those least able to adapt, such as small businesses, will bear the brunt of this change – and the returning HGV levy.Green policy u-turns

Encouraged by their success in winning the Uxbridge and South Ruislip byelection by campaigning against ULEZ, the Tories have since announced plans to revisit their environmental policies.

Rishi Sunak has just confirmed he’ll seek to ‘max out’ the UK fossil fuel reserves, while Downing Street previously said the 2030 ban on new petrol and diesel car production is being reexamined.

Now, many in the road transport industry are questioning whether the government will actually ban production of new small diesel trucks (by 2035) and new 26-tonne-plus trucks (by 2040).

This means uncertainty for operators considering switching to an electric fleet – and those who’ve made the switch in the hope of infrastructure improvements.

Some hauliers and couriers might follow the example of Royal Mail and PepsiCo, who’ve introduced hydrotreated vegetable oil (HVO) as an alternative fuel. It’s a less expensive and time-consuming switch than going to EVs, and every HVO mile creates 80% less greenhouse gases than diesel.

Lyall Cresswell, CEO at Transport Exchange Group and new platform Integra, says: “While it could feel like a reprieve for some, the government’s u-turn on green policy will leave many road transport firms disappointed. Those who’ve invested in electric fleets might feel they’ve been left high and dry. They may now have doubts about whether any improvements in EV infrastructure will be forthcoming.

“For years, the government has been encouraging operators to go electric. And, of course, the most effective way to encourage EV adoption is the upcoming ban on new diesel vehicles. If the government scraps that ban, years of planning could go out of the window for some companies.

“HVO fuel will now play an even more important role in helping the road freight industry decarbonise much of its activity, before true net zero is feasible for many companies. The good news — particularly for smaller firms – is that HVO fuel is cheaper and quicker to introduce, allowing companies to become greener sooner.”

Kirsten Tisdale, Director of Logistics Consultants Aricia Limited and Fellow of the Chartered Institute of Logistics & Transport, says: “The Bank of England has just put the rate of interest up for the fourteenth time to continue to fight inflation. However, the Courier element of the TEG Road Transport Index is deflationary for the first time in over 30 months and the haulage element has been showing year-on-year deflation for fourteen months. The price of fuel has come down from its high a while back, and there’s a bit less pressure for many on the staffing side at the moment, although that pressure will change as we approach peak. But I can’t be the only one asking: is that interest rate increase one too many?”

.gif?rand=3507)